Understanding Diminished Value After an Accident and Why It Matters

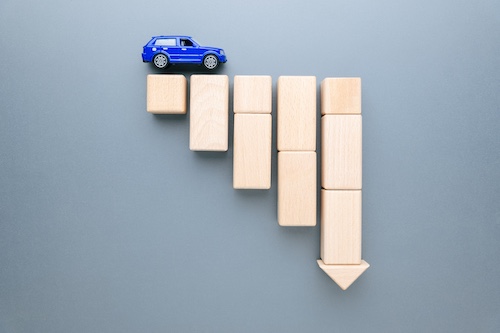

When a vehicle is involved in a collision, its value often changes in ways that are not immediately obvious. Even after professional repairs are completed, a car’s history now includes an accident record. This loss in market perception is known as diminished value, and it can directly affect vehicle resale value after an accident. Many owners are surprised to learn that a repaired vehicle may be worth significantly less than it was before the crash, despite looking and driving normally.

A common misconception is that “fully repaired” means “fully restored.” In reality, buyers, dealers, and valuation tools often discount vehicles that have been in accidents, regardless of repair quality. This means that after any accident, vehicle owners may experience a hidden financial loss that is not addressed by standard repair payments. Understanding diminished value after an accident is essential for anyone seeking fair financial compensation.

Claims Concierge helps car accident owners navigate this often-overlooked aspect of accident recovery. By explaining how diminished value works, identifying when a claim may apply, and clarifying available recovery options, Claims Concierge empowers owners to pursue what they are rightfully owed. With a clear, supportive approach, the focus is on protecting vehicle resale value and helping owners move forward with confidence and clarity.

What Is Diminished Value and How Does It Affect Your Vehicle?

Diminished value refers to the reduction in a vehicle’s market value that occurs after an accident, even when repairs are completed to professional standards. While a car may look and function as it did before the collision, its accident history becomes a permanent part of its record. That history alone can lower vehicle resale value, creating a financial gap that many vehicle owners do not anticipate.

How an Accident Impacts Vehicle Resale and Trade-In Value

After any accident, vehicles are often flagged in history reports used by buyers, dealerships, and valuation platforms. These records signal that the vehicle has sustained damage, which can influence perceptions of reliability, safety, and long-term performance. As a result, sellers may receive lower offers when trading in or selling a repaired vehicle, even if the damage was minor. This loss in value is a form of financial compensation that is frequently overlooked during the claims process.

Why Repaired Vehicles Still Sell for Less

Buyers and dealers tend to approach previously damaged vehicles with caution. Concerns about hidden structural issues, future repair needs, or reduced longevity often lead to discounted pricing. This is why diminished value represents a separate market consideration beyond the scope of repair coverage, which successfully restores the vehicle’s functionality and appearance.

Claims Concierge helps vehicle owners clearly understand diminished value and how it affects real-world pricing. By breaking down how accident history influences market behavior, Claims Concierge supports informed decisions and helps owners pursue fair financial compensation tied to true vehicle resale value.

Why Vehicles Lose Value Even After Proper Repairs

Many vehicle owners expect that once repairs are finished, their car will return to its original standing. In reality, market forces often tell a different story. Even when a vehicle looks and drives as it did before, pricing decisions are influenced by factors that go beyond visible condition, including buyer expectations and historical data tied to prior damage.

The Long-Term Impact of an Accident Record

Once an incident is recorded, it becomes part of a vehicle’s permanent history. Pricing tools, dealers, and individual buyers commonly review these records before making offers. A single reported event can affect how a vehicle is evaluated in the marketplace, regardless of repair quality, and can influence future selling or trade-in discussions.

Buyer Perception and Market Caution

Buyers tend to be cautious with vehicles that have a repair history. Even thorough inspections may not eliminate concerns about longevity, performance, or unforeseen issues. This hesitation can lead to lower offers, reflecting how perception shapes market behavior more than the actual condition of the car.

How Different Repairs Are Viewed

The type of repair also matters. Structural work may raise safety questions, cosmetic fixes can signal prior damage, and mechanical repairs may suggest added wear. Each can subtly influence how a vehicle is priced later on.

Why Repair Coverage Has Limits

Repair coverage focuses on restoring usability, not addressing how the market responds afterward. Claims Concierge helps vehicle owners understand this disconnect and navigate the process with clarity, confidence, and a focus on fair outcomes.

The Three Types of Diminished Value Explained

Understanding how value loss is categorized helps vehicle owners make sense of what happens after an accident and why market pricing may change. While the concept of diminished value is often discussed broadly, it typically falls into three distinct types. Each reflects a different reason a vehicle’s worth may decline and can influence vehicle resale value in unique ways. Claims Concierge helps simplify these distinctions so owners can pursue appropriate financial compensation with clarity and confidence.

Inherent Diminished Value

Inherent diminished value refers to the loss in market worth that occurs simply because a vehicle has been involved in an accident. Even when repairs are completed correctly and the vehicle performs as expected, the accident history alone can affect buyer perception. This type of diminished value exists regardless of repair quality and is closely tied to how future buyers evaluate risk, reliability, and long-term ownership. As a result, inherent diminished value can surface later when selling or trading in the vehicle.

Immediate Diminished Value

Immediate diminished value reflects the reduction in a vehicle’s worth right after an accident occurs and before any repairs are made. This type is often most relevant in situations involving unrepaired damage or vehicles that are declared a total loss. In these scenarios, the market responds to visible damage and uncertainty, which can significantly influence short-term pricing and settlement considerations.

Repair-Related Diminished Value

Repair-related diminished value arises when repairs do not fully restore the vehicle to its prior condition. Factors such as incomplete workmanship, cosmetic inconsistencies, or the use of aftermarket or non-OEM parts can affect how the vehicle is valued. This type highlights how repair choices can influence long-term resale outcomes.

Claims Concierge supports vehicle owners by clarifying these categories and explaining how each may apply, helping them better understand their options and pursue fair recovery with confidence.

How Value Loss Is Evaluated After a Vehicle Incident

Knowing how changes in market value are assessed can help owners feel more confident about the next steps following a collision. While value changes may seem difficult to quantify, they are usually examined through recognizable criteria and structured review methods. These assessments influence how a vehicle is positioned over time and can affect future selling outcomes. Claims Concierge is committed to breaking this process down in a way that is easy to follow and grounded in real-world reasoning.

Factors Commonly Reviewed During Evaluation

Several characteristics are typically examined when determining how a vehicle’s market standing may shift. Age and accumulated mileage help set expectations, while the vehicle’s condition before the incident provides a point of comparison against similar models. Vehicles that were newer or especially well-maintained before the event may experience more noticeable changes in pricing than those with higher use.

The nature of the damage also plays a role. Issues involving structural components, safety systems, or extensive body work tend to carry more weight than minor surface repairs. How thoroughly the work was completed and how well it blends with the vehicle’s original condition can influence buyer confidence down the road.

Estimation Methods Often Used by Insurers

Insurers use standardized formulas and automated tools designed for efficiency and consistency across thousands of claims. Claims Concierge complements these processes by providing additional market-based analysis that can offer deeper insights into specific local market conditions and buyer behavior. As a result, the figures produced can differ from what a vehicle may realistically command in future transactions.

Why Market-Based Reviews Provide Deeper Insight

Independent evaluations often look beyond formulas by analyzing comparable sales, current demand, and pricing trends. This broader perspective can offer a more accurate reflection of how an incident influences long-term market perception. Claims Concierge helps vehicle owners understand these distinctions, offering clarity and guidance that support informed, confident decision-making.

Why Many Vehicle Owners Don’t Realize a Value-Based Claim May Exist

After a collision, most attention naturally goes toward repairs and returning to normal routines. What is often overlooked is how a vehicle’s market position can continue to shift even when the work is complete. Because post-repair value changes are rarely discussed in everyday conversations, many owners never consider whether additional recovery options may apply. Claims Concierge focuses on bringing awareness to this frequently misunderstood aspect of accident recovery.

Limited Information During the Claims Process

The claims process focuses primarily on restoring vehicles to pre-accident condition through visible damage repair and approval. Once repairs are completed, the claim typically concludes. Claims Concierge provides an additional service by helping vehicle owners understand market-related value considerations that extend beyond the repair phase, complementing the work already completed by insurers.

Misconceptions About Full Restoration

Many people equate completed repairs with being fully compensated. While repairs restore drivability and appearance, they do not always restore how the vehicle is viewed in future transactions. This disconnect between condition and market response can affect later selling or trade-in discussions.

Perceived Complexity and Hesitation

Evaluating market-related value changes can feel technical or overwhelming. The need to review documentation, historical records, and pricing data can create the impression that the process is difficult to navigate without guidance, causing some owners to opt out entirely.

Limited Public Education on Vehicle Value Changes

Discussions about post-accident value shifts are uncommon outside specialized circles. Claims Concierge helps close this information gap by offering clear explanations, simplifying next steps, and empowering vehicle owners to make informed decisions with confidence and clarity.

Understanding Your Diminished Value Coverage Options

After an accident, many vehicle owners may not realize that the financial impact extends far beyond repair costs. While a car may be fully functional after repairs, its vehicle resale value can still take a hit, and this reduction is referred to as diminished value. This hidden financial loss is often overlooked in the claims process, but it is a legitimate concern that deserves attention. Claims Concierge is here to help vehicle owners understand why they should be compensated for this loss.

The Effect of Diminished Value on Resale and Trade-In Negotiations

When trying to sell or trade in a vehicle that has been involved in an accident, potential buyers and dealerships often consider the car’s accident history, even if repairs were done correctly. This stigma can result in offers well below the vehicle’s pre-accident market value. The diminished value that results from this perception can have a lasting effect on your ability to get a fair price when you decide to sell or trade your vehicle.

The Financial Impact on Vehicle Owners

The financial burden of diminished value is a significant concern. Vehicle owners may not realize that the financial compensation they received for repairs may not cover the full extent of their loss. The gap between what a car is worth post-accident and its market value before the crash can result in thousands of dollars in lost resale value. This is particularly true for vehicles with higher pre-accident value or those that are in high demand.

Why Diminished Value Is a Legitimate, Measurable Loss

Diminished value isn’t just an abstract concept—it is a quantifiable loss. Market data, vehicle history reports, and valuation models all confirm that cars involved in accidents, even when repaired to high standards, typically lose significant value. This loss isn’t something vehicle owners should bear alone. It’s a legitimate concern that directly affects future financial transactions, whether selling the vehicle privately, trading it in, or using it as collateral.

When Insurance Policies May Cover Diminished Value Claims

In many cases, insurance policies can cover diminished value claims, especially when the vehicle owner is not at fault. Many policyholders are unaware that diminished value coverage may be available under their policy. Claims Concierge specializes in helping policyholders and insurers work together to identify all applicable coverage benefits and ensure complete claim resolution.

At Claims Concierge, we believe you deserve to be compensated for the true impact of a vehicle accident, which includes the diminished value that affects your car’s future resale potential. With expert guidance and a focus on fairness, we are here to help you secure the financial compensation you deserve.

How Claims Concierge Helps Recover Diminished Value

Navigating value loss after an accident can feel confusing, especially when the focus is often limited to repairs rather than long-term impact. Claims Concierge was created to simplify this process and help vehicle owners clearly understand how diminished value affects real-world outcomes. With a structured, supportive approach, Claims Concierge turns a complex issue into a manageable path toward fair financial compensation.

Expert Evaluation of Vehicle Value Loss

Claims Concierge begins with a detailed review of how an accident may influence a vehicle’s market position. By analyzing vehicle history, repair records, and current market data, the process identifies whether diminished value exists and how it may affect vehicle resale value. This expert-driven evaluation provides clarity and sets realistic expectations based on measurable factors rather than assumptions.

Managing Documentation and Insurance Communication

Paperwork and insurer communication are often the most frustrating parts of the process. Claims Concierge handles the collection and organization of key documents, ensuring that valuation details, repair information, and supporting evidence are presented clearly. This structured approach helps reduce delays and keeps conversations focused on documented value loss and appropriate financial recovery.

Removing Stress and Uncertainty From the Process

Many vehicle owners are unaware that diminished value can be addressed at all, which adds unnecessary stress. Claims Concierge removes uncertainty by explaining each step in plain language, helping customers understand how decisions are made and what outcomes to expect after an accident.

Helping Customers Recover Overlooked Compensation

Most importantly, Claims Concierge helps customers access coverage benefits they may not have known were available under their policy. By highlighting the connection between diminished value and future resale challenges, the service empowers owners to protect their investment and move forward with confidence, clarity, and peace of mind.

Moving Forward With Confidence After an Accident

When a collision occurs, the impact often extends beyond visible damage and repair invoices. Diminished value plays a meaningful role in what happens next, influencing how a vehicle is viewed in the market and how its resale value may change over time. Understanding this hidden loss after an accident helps vehicle owners recognize that repairs alone do not always reflect the full financial picture.

By learning how accident history affects pricing, negotiations, and long-term ownership outcomes, owners can better understand the true cost of value loss. This awareness creates an opportunity to pursue appropriate financial compensation tied to real-world market behavior rather than assumptions about restoration.

Claims Concierge is dedicated to helping vehicle owners gain clarity around diminished value and the options available to address it. With a professional, educational approach, Claims Concierge simplifies the process and removes uncertainty from complex evaluations.

If your vehicle has been involved in an accident and you want to understand how its value may have changed, now is the time to take action. Contact Claims Concierge today to request a professional diminished value assessment and take the next step toward protecting your vehicle’s long-term value with confidence and peace of mind.