Why Many Policyholders Choose DIY Insurance Claims—and What Often Gets Missed

When an accident or loss occurs, many consumers choose DIY (do-it-yourself) insurance claims because the process appears straightforward. Filing online forms, uploading documents, and communicating directly with insurers can feel efficient and empowering. There is a common belief that handling a claim independently will save both time and money, especially when the damage seems manageable or the policy language appears clear at first glance.

However, this approach often overlooks hidden costs that are not immediately obvious. Settlement calculations, valuation assumptions, depreciation methods, and coverage interpretations can quietly influence outcomes. Without specialized review, these factors may lead to settlement shortfalls that policyholders do not recognize until long after the claim is closed. What feels like a quick resolution can sometimes result in unrecovered value or missed benefits.

Claims Concierge supports policyholder advocacy by helping consumers see beyond the surface of the claims process. By reviewing documentation, identifying valuation gaps, and clarifying how decisions are made, Claims Concierge helps policyholders avoid costly, unseen losses. The goal is not to complicate the process, but to bring transparency, confidence, and informed decision-making to insurance claims—ensuring that settlements more accurately reflect what policyholders are entitled to receive.

Why DIY Insurance Claims Feel Appealing at First

At the outset, DIY insurance claims often appear to be a practical and cost-effective choice. Policyholders are frequently reassured by streamlined online portals, clear instructions, and friendly initial communication. This early experience can reinforce the belief that insurers will “do the right thing,” making it seem unnecessary to seek outside help or engage in formal policyholder advocacy.

The Assumption That Everything Will Be Handled Fairly

Many people begin the claims process trusting that coverage will be applied accurately and that outcomes will reflect the full extent of the loss. When early updates are prompt and the process feels cooperative, it can create confidence that the final settlement will be fair, reducing concern about potential settlement shortfalls.

Avoiding Fees and Extra Steps

Another common motivation behind DIY insurance claims is the desire to avoid professional fees. Handling everything independently feels like a way to keep more money in hand. What is often overlooked are the hidden costs that can arise when valuation methods, depreciation, or policy language are not fully examined.

Confidence in Managing Paperwork and Negotiations

Many policyholders feel comfortable completing forms and exchanging emails, especially when the process appears procedural. However, claims often involve negotiation points that are not clearly labeled as such. Without experience, subtle assumptions can go unchallenged.

When Simplicity Turns Into Complexity

What begins as a simple process can become complicated when discrepancies appear or settlement numbers feel unclear. At that point, policyholders may realize that DIY insurance claims require more than paperwork—they require insight. Claims Concierge helps bridge that gap, offering clarity and support when complexity emerges.

The Time Cost Most People Underestimate

One of the least visible downsides of DIY insurance claims is the amount of time they quietly consume. What initially feels manageable can quickly expand into hours of effort spread across days or weeks. While these time demands are rarely listed as line items, they often represent some of the most significant hidden costs policyholders experience during the claims process.

Time Spent on Calls, Follow-Ups, and Repetition

Policyholders handling claims on their own often spend substantial time on hold, waiting for callbacks, or repeating the same explanations to different representatives. Each interaction may feel minor, but together they add up. These repeated touch-points can also contribute to settlement shortfalls when fatigue or frustration leads to accepting explanations or outcomes without deeper review.

Managing Emails, Documents, and Deadlines

DIY insurance claims require careful organization. Emails, photos, estimates, forms, and policy documents must be tracked and submitted correctly, often under tight timelines. Missing or misinterpreting a request can delay progress or shift outcomes. Without structured policyholder advocacy, it is easy for important details to get lost in the back-and-forth.

Lost Work Hours and Personal Time

Time spent managing a claim frequently comes at the expense of work responsibilities or personal life. Taking calls during business hours, gathering documents after work, or responding to follow-ups on weekends creates real opportunity costs that are rarely considered upfront.

Why Time Becomes the Most Expensive Factor

While DIY insurance claims may appear to save money initially, the cumulative time investment often outweighs expectations. Claims Concierge helps policyholders reclaim that time by providing guidance, clarity, and advocacy—reducing hidden costs while supporting more informed, confident outcomes.

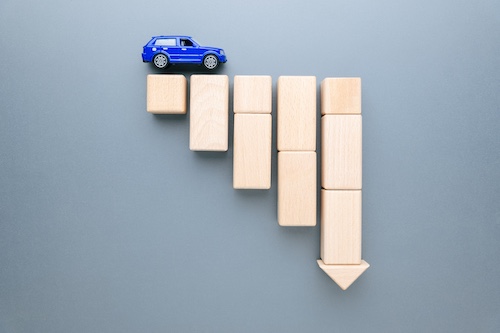

Financial Losses You Don’t See on the Surface

One of the most overlooked risks of DIY insurance claims is financial loss that isn’t immediately obvious. While an initial offer may seem reasonable at first glance, subtle valuation choices and assumptions can quietly shape outcomes. These unseen factors often create hidden costs that only become clear when it’s too late to revisit the claim.

Why Initial Offers May Fall Short

Early settlement figures are frequently based on standardized formulas or baseline assumptions. Without deeper review, these numbers can miss important details related to condition, usage, or replacement standards. When policyholders manage claims on their own, these gaps may go unchallenged, leading to avoidable settlement shortfalls.

Missed Opportunities to Question Valuations

Insurance valuations often include negotiable components, even if they are not labeled that way. Do-it-yourself insurance claims can make it difficult to recognize where assumptions are flexible or where supporting documentation could change the outcome. Without experienced policyholder advocacy, inaccuracies may remain embedded in the final settlement.

Limited Leverage Without Negotiation Experience

Negotiation is rarely framed as part of the claims process, yet it plays a meaningful role. Without familiarity with valuation methods or insurer practices, policyholders may lack the leverage needed to push back confidently or effectively.

How Small Differences Add Up

Even modest percentage changes in a settlement can translate into significant dollars. Claims Concierge helps policyholders understand where value may be left on the table, bringing clarity to financial outcomes and helping reduce losses that are easy to miss but costly to ignore.

Rental Car and Transportation Headaches

Transportation/car challenges are one of the most frustrating—and least anticipated—side effects of DIY insurance claims. While coverage for temporary transportation is often included, the details surrounding limits, timing, and reimbursement can be unclear. These gray areas frequently lead to hidden costs that catch policyholders off guard.

Unclear Coverage Limits and Timeframes

Rental coverage is typically subject to daily caps, total limits, and specific eligibility rules. Without clear guidance, policyholders may assume broader coverage than what actually applies. This misunderstanding can result in uncovered days or reduced reimbursement, contributing to unexpected settlement shortfalls tied to transportation expenses.

Delays Between Approval and Access

Even when rental coverage is approved, coordination issues can create gaps. Delays in authorization, scheduling, or documentation can leave policyholders without transportation at critical moments. Managing these logistics alone often requires repeated follow-ups and explanations—an added burden of DIY insurance claims.

Out-of-Pocket Costs From Miscommunication

Misaligned expectations between insurers, rental providers, and policyholders can lead to charges that were never anticipated. Daily rate overages, extended rental periods, or missed approvals often become the policyholder’s responsibility when communication breaks down.

Why DIY Claimants Often Pay More

Without experienced policyholder advocacy, small misunderstandings can turn into real expenses. Claims Concierge helps clarify coverage details, reduce confusion, and support informed decisions—minimizing transportation-related stress and helping policyholders avoid paying more than necessary.

The Stress Factor No One Talks About

One of the most overlooked consequences of DIY insurance claims is the cumulative stress that builds throughout the process. Beyond forms and figures, managing a claim requires sustained emotional energy at a time when policyholders are already coping with disruption, inconvenience, or loss. This mental and emotional strain represents one of the most significant hidden costs of handling a claim alone.

The Emotional Weight of Ongoing Negotiations

Negotiating with insurers can feel unfamiliar and high-pressure. Policyholders may worry about saying the wrong thing, missing an opportunity, or misunderstanding a response. Each interaction carries financial implications, which can heighten anxiety—especially when outcomes affect transportation, housing, or long-term expenses. Without structured policyholder advocacy, these conversations often feel one-sided and exhausting.

Frustration From Inconsistent Communication

Another major source of stress comes from inconsistent or fragmented communication. Adjuster changes, delayed replies, or shifting explanations force policyholders to repeatedly re-engage with the process. Over time, this creates frustration and erodes confidence in decision-making.

Common stress triggers include:

- Repeating the same details to multiple representatives

- Waiting days for responses while deadlines approach

- Receiving unclear or contradictory guidance

Decision Fatigue During an Already Stressful Time

DIY insurance claims require frequent choices—approving estimates, responding to requests, deciding whether to push back, or accepting explanations at face value. Making these decisions repeatedly, while juggling work and personal responsibilities, can lead to decision fatigue. This mental overload increases the likelihood of overlooking details that contribute to settlement shortfalls.

Why Stress Has Real Personal and Financial Consequences

Stress doesn’t just affect emotional well-being—it can directly influence outcomes. When frustration peaks, policyholders may accept terms simply to move on, unintentionally absorbing losses they could have avoided. Over time, this compounds the true cost of DIY insurance claims.

Real-World Examples: DIY vs. Professionally Managed Claims

Comparing outcomes side by side helps illustrate how DIY insurance claims often differ from professionally supported ones. While every situation is unique, anonymized case patterns consistently show how guidance and policyholder advocacy can reduce hidden costs, prevent settlement shortfalls, and streamline resolution. Below are representative examples that reflect common outcomes seen across many claims.

Example 1: Total Loss Settlement Improved After Review

In one scenario, a policyholder accepted an initial total loss offer after reviewing the valuation independently. The figure appeared reasonable, but a professional review later identified pricing assumptions and comparable selections that did not fully reflect market conditions. With targeted analysis and follow-up, the settlement was adjusted upward—closing a gap the policyholder did not initially recognize. This example highlights how DIY insurance claims can overlook negotiable valuation components.

Example 2: Overlooked Vehicle Upgrades Recovered

Another case involved a repaired vehicle where optional features and recent upgrades were not included in the initial evaluation. During a professionally managed review, documentation supporting these additions was presented clearly, resulting in additional compensation. Without expert negotiation, these details would have remained unaccounted for, contributing to avoidable settlement shortfalls.

Example 3: Faster Resolution With Structured Support

In a third comparison, a policyholder managing the claim independently experienced repeated delays, follow-ups, and timeline extensions. With claim management support in place, communication became more consistent, documentation was organized, and decisions moved forward without repeated interruptions—saving time and reducing stress.

What These Comparisons Reveal

Across these examples, a consistent pattern emerges:

- DIY insurance claims often miss recoverable value

- Hidden costs surface after settlements are finalized

- Policyholder advocacy leads to clearer, more confident outcomes

Claims Concierge helps bridge the gap between uncertainty and clarity, ensuring policyholders benefit from informed review, effective communication, and outcomes that more accurately reflect what they are entitled to receive.

When DIY Makes Sense—and When It Doesn’t

Not every insurance situation requires the same level of support. In some cases, DIY insurance claims can be manageable, while in others, they can expose policyholders to hidden costs and unexpected settlement shortfalls. Knowing the difference helps policyholders decide when handling a claim independently is reasonable and when policyholder advocacy may offer meaningful value.

Situations Where DIY May Be Sufficient

Claims that involve minor damage, clear coverage, and straightforward repairs are often easier to manage independently. When estimates align closely, communication is consistent, and no valuation questions arise, DIY insurance claims can feel efficient and uncomplicated. In these scenarios, policyholders may be comfortable tracking documentation and timelines on their own.

When Claims Become More Complex

Complexity increases when valuation enters the picture. Total loss determinations, depreciation questions, repair quality concerns, or reimbursement limits often require deeper review. These situations introduce variables that are not always explained clearly, making it harder to assess whether the settlement fully reflects the loss.

Signs a Claim May Be Undervalued

Certain indicators suggest a closer look may be warranted:

- Settlement figures feel lower than expected without a clear explanation

- Comparable values or repair assumptions are not transparent

- Coverage limitations surface late in the process

Red Flags That Professional Support May Pay Off

Repeated delays, shifting explanations, or pressure to settle quickly can signal increased risk of missed value. In these moments, professional guidance often helps uncover hidden costs and reduce the likelihood of settlement shortfalls.

Claims Concierge helps policyholders evaluate these situations calmly and objectively—providing clarity, informed guidance, and advocacy when it matters most, while supporting confident decisions every step of the way.

How Claims Concierge Removes the Hidden Costs of DIY Insurance Claims

Many of the challenges associated with DIY insurance claims stem from unseen gaps in communication, valuation, and time management. These gaps often translate into hidden costs that policyholders only recognize after a settlement is finalized. Claims Concierge was created to address those issues directly—bringing clarity, structure, and policyholder advocacy to every stage of the claims process.

Managing Communication and Negotiations

One of the most time-consuming aspects of DIY insurance claims is ongoing communication with insurers. Claims Concierge takes on this responsibility, ensuring that questions are answered promptly, documentation is submitted correctly, and negotiations remain focused and informed. This reduces misunderstandings that often lead to settlement shortfalls.

Identifying Overlooked Value

Claims Concierge reviews claims with an experienced eye, looking for valuation gaps, missing documentation, or assumptions that may undervalue a loss. By identifying overlooked value early, policyholders are better positioned to address discrepancies before decisions become final.

Saving Time and Reducing Stress

By handling follow-ups, organizing records, and guiding next steps, Claims Concierge helps policyholders reclaim time and reduce emotional strain. Less stress means clearer decisions and fewer rushed choices that can increase hidden costs.

Providing Transparency and Ongoing Advocacy

Throughout the process, Claims Concierge prioritizes transparency. Policyholders are kept informed, supported, and confident in each decision. With consistent policyholder advocacy, outcomes are clearer, more balanced, and aligned with what policyholders are truly entitled to receive.

Looking Beyond the Surface of DIY Insurance Claims

At first glance, do-it-yourself insurance claims often appear efficient and cost-effective. Yet, as this guide has shown, the true cost is rarely limited to what appears on a settlement statement. Time spent managing communication, stress from ongoing decisions, and missed opportunities to question valuations all contribute to hidden costs that can quietly reduce the value of a claim. These factors often lead to settlement shortfalls that policyholders do not recognize until long after the process is complete.

Looking beyond the initial offer is one of the most important steps a policyholder can take. Settlement figures may reflect standardized assumptions rather than the full scope of loss, and without experienced policyholder advocacy, it can be difficult to know whether the outcome truly aligns with what the policy allows. A second look can reveal details, options, and adjustments that are easy to miss when handling a claim alone.

Claims Concierge exists to support informed decision-making. Before accepting less than you deserve, consider consulting Claims Concierge for clarity, transparency, and guidance. With the right support, policyholders can move forward with confidence—knowing their claim has been reviewed thoughtfully and their interests have been fully represented.